Does "wealth management consulting" sound dull and conservative? Not at Deutsche Vermögensberatung! DVAG IT and DVAG Education Management (DAV) are embracing modern online learning and two different approaches to blended learning. In this interview, Gabriele Feist (DVAG-IT) and Matthias Spiegel (DAV) explain both approaches -- and how their training and development of financial advisors rides on the blink.it learning platform.

Note: DVAG (Deutsche Vermögensberatung) is Germany's largest and most important independent financial advisor with almost eight million clients, certified top products and regular awards.

|

|

Gabriele Feist (DVAG-IT) is the department head responsible for, among other things, the design and implementation of IT training measures. For almost three years, these have been offered to the approximately 17,000 full-time financial advisors of Deutsche Vermögensberatung in a blended learning format on the blink.it platform. |

|

Matthias Spiegel (DAV) is from education management. Together with colleagues from media development, he’s responsible among other things for the blink.it platform of the German academy for wealth advisors. There, blink.it is used to support and accompany the training and further education of investment advisors. |

Over 25,000 online learning units were completed last month at DVAG and DAV. What kind of lessons do you impart to your wealth advisors with blink.it?

M. Spiegel: At DVAG, we actually have two blink.it platforms in use: One for our IT systems and one for the actual investment advisor training at DAV (the German academy for wealth advisors).

At the academy, we are responsible for the professional training and further education of investment advisors, as well as for their management training. The whole thing usually starts with the start-up of the business, with directors guiding new investment advisors. For this purpose, we have used blink.it to provide directors with learning material. Up-and-coming wealth advisors can thus familiarize themselves with the most important topics online. But we also provide documents to conduct trainings and seminars on site.

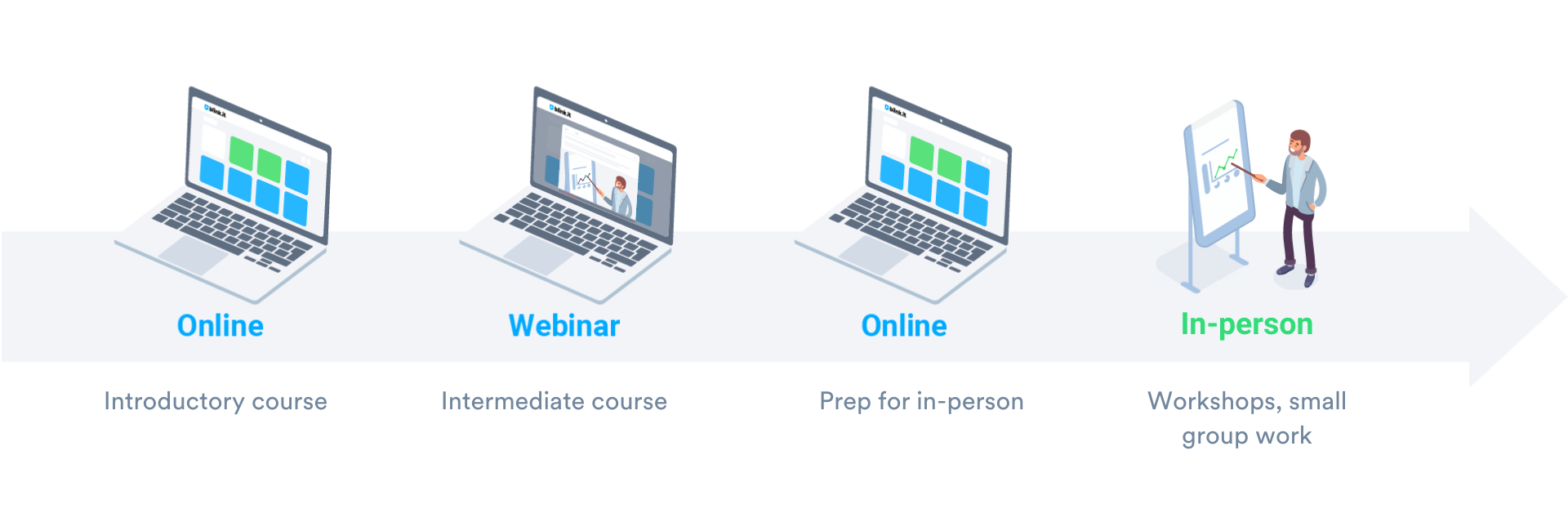

G. Feist: On the IT platform, the focus is on how to handle our digital support tools, especially the apps and tools developed specifically for DVAG. We do standard courses according to the blended learning principle and use these as learner support. We build an individual measure for our directors by request, consisting of an online course in combination with a webinar and/or a face-to-face event.

Why did you decide on blended learning instead of pure e-learning?

G. Feist: We came to blended learning because we have around 17,000 full-time investment advisors and we can't train them all in face-to-face seminars. That’s simply not possible from an organizational point of view. We needed another solution to train our investment advisors in the use of our software: If we combine webinars with online courses, many more advisors can benefit from our training activities.

M. Spiegel: At DAV, we wanted to give wealth advisors the choice of how they wanted to take on the learning content. It used to be that there were face-to-face events for everything. Today, there is the option of learning every single topic either in person or online. You can even combine both forms.

We see this choice as an offer and also as a service from us. Wealth advisors are a very heterogeneous group, age-wise, and thus the preferred form of learning is also very different. With face-to-face and online courses, we can ideally serve all target groups.

Who creates and manages these flexible learning offerings for the two blink.it platforms?

G. Feist: In IT, these tasks are handled by a learning architect: A colleague from adult education with a corresponding degree. He is responsible for conceptualizing the courses to create suitable blended learning. The media are also created by our own staff.

M. Spiegel: Within DAV, a team of five people typically takes care of the blink.it platform. In consultation with the other departments, the content is maintained and expanded.

DVAG’s blended learning model with blink.it

Some of your online courses have thousands of participants – as many as ten thousand. How do you organize these large courses – and how do you monitor learning progress with so many participants?

G. Feist: Around 17,000 full-time financial advisors have direct access to the basic courses explaining our IT systems and digital tools. Here, the investment advisors can organize themselves independently and set their own learning pace.

In the individual courses, our trainers monitor learning progress. However, there are only 30-60 participants here. This is the only way we can ensure that everyone has a similar level of knowledge on-site every day. We also check whether homework is being done, for example, and introduce assignments in advance. That way, participants can also ask questions that we can then address in more detail during the practice day. In this case, our trainers take on the role of a guide.

Why did you choose blink.it as the platform to implement these very different learning concepts?

G. Feist: We got a hot tip to try blink.it from our external consultant and blink.it fan Heike Molin. We were explicitly looking for something simple and self-explanatory that even PC beginners could handle. We were easily persuaded by the simplicity of blink.it and the fact that the content can be edited on all mobile devices.

M. Spiegel: An additional point is the functionality of adapting to the corporate design. We recently updated our own corporate design at DAV and were amazed at how well the platform could be integrated visually at our company.

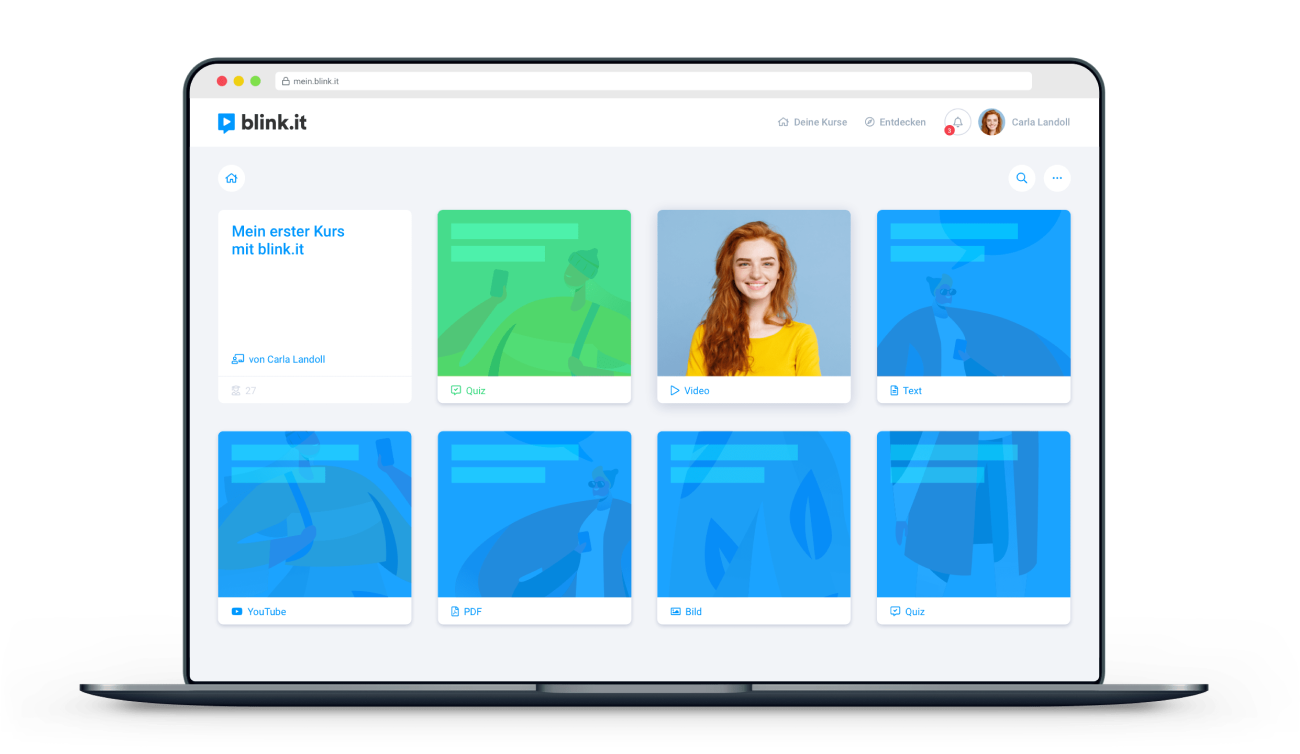

A glimpse at DVAG's blink.it learning platform: A basic course for all investment advisors with around 17,000 participants. Source: blink.it

Finally, a look at your employees: How do they like blink.it and your flexible learning concepts?

G. Feist: Since we originally had a lot of face-to-face events in IT, we naturally had to struggle with acceptance problems in the beginning. There were many who did not want online courses, but preferred to have a person on site. The compelling point for our participants was the short learning content: they can watch videos on the way to a client or in the evening, on the couch. When we catch up with our investment advisors online after face-to-face events - for example, with summaries or photos - we get feedback that the format helps them recall content.

M. Spiegel: The fact that investment advisors have the option of using the online content to supplement the face-to-face events and refresh what they learned is also very well received. Most of the feedback we receive is very positive!

Thanks so much for these exciting insights into DVAG and DAV, Ms. Feist and Mr. Spiegel!